Expertise

Liability-Driven Investing

Our goal

We aim to help institutional investors generate stable income while optimizing capital efficiency. That’s why we work closely with clients to develop a tailored strategy that focuses on the behaviour of the total asset portfolio, fits their organization and aims to deliver long-term value.

European regulatory expertise

Regulatory, accounting and risk management expertise is in our company DNA. This deep, specialist expertise – honed over time – ensures each of our LDI solutions is tailored for resilience and long-term value.

Unlike many managers focused on their home markets, our knowledge of insurance regulation spans all European countries. This gives us a distinct edge in an area where subtle regulatory differences are common.

Our LDI strategies: Fixed income, equity, and alternative investments

We offer fully bespoke solutions that can integrate fixed income, equities, multi-asset, alternative investments, and quantitative approaches aiming to enhance returns and resilience. Our liability-driven, cashflow-driven, and risk-controlled1 strategies are backed by advanced asset allocation and quantitative portfolio management. Our approach is underpinned by three core strategies:

Fixed income leadership – Our fixed income team combines macroeconomic and credit expertise with deep regulatory understanding, making sure every investment meets international standards while aiming to maximize risk-adjusted returns.

Equity conviction - Our equity team aims to generate positive, market-beating results over a cycle to create a buffer of unrealized gains, together with a recurring stream of income.

Exclusive private markets access – We offer professional investors the opportunity to invest in private markets alongside Generali Group, one of the world’s largest asset owners and a cornerstone investor for many of these strategies. With a proven track record in managing private market portfolios, our offer aims to help investors achieve their investment goals while contributing to the real economy.

Sebastiano Chiodino

Head of Liability-Driven Investing

Industry experience: 25 years

How do our investment solutions come to life?

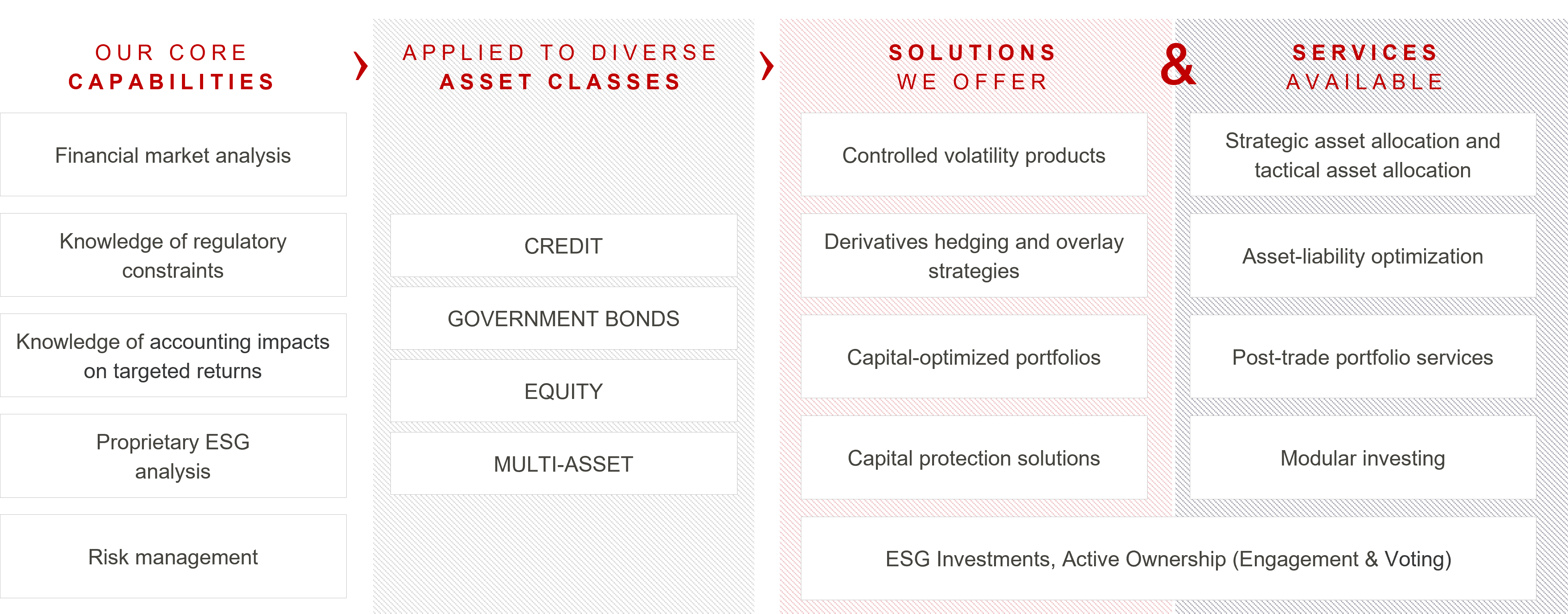

Drawing on our key capabilities, we provide tailored investment solutions and services for the unique investment challenges of our clients

Source: Generali Asset Management S.p.A. Società di gestione del risparmio as at end of Q4 2024.

1 Risk control involves implementing measures to reduce the probability or impact of potential risks. However, risks can never be fully controlled, so the sub-fund presents a risk of loss of capital. There is no guarantee that the investment objective will be reached. Investors may not get back the initial invested amount.