Private Debt Outlook 2025: Growth, Opportunities, and the Rise of the Secondary Market

In Short

Global assets growing to $1.8 trillion globally as of the end of 2024. In Italy, the development of the segment continues

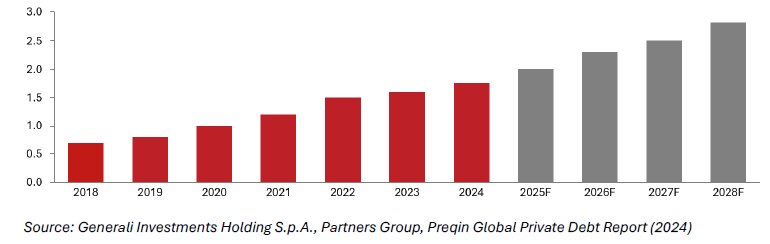

Private Debt continues to gain traction as a major segment within alternative investments. From more than $1.8 trillion in Assets under Management (AuM) in 2024 globally, this segment is expected to grow to about $2 trillion in 2025 according to estimates by Generali Asset Management*. By 2028, Global Private Debt AUM is expected to grow even further to $2.8 trillion, with a CAGR of 11% from 2024.

In 2025, North America is projected to remain the fastest-growing region, with AuM reaching $1.1 trillion, up from $1.01 trillion in 2024. Europe follows, with AuM expected to grow to approximately $487 billion, compared to $453 billion the previous year.

The average internal rate of return (IRR) is also on the rise, increasing from 8.1% during 2017–2023 to an anticipated 12% for the 2023–2029 period. Notably, distressed debt strategies are forecasted to outperform, delivering an average IRR of 13.4% over the same timeframe.

Private Debt AUM ($Tn) 2018-2028 Forecast

Private Debt’s role in capital markets

Private Debt refers to a form of non-bank lending extended to businesses by alternative lenders, such as specialized asset managers investing on behalf of institutional investors, e. g., pension funds, insurance companies, and sovereign wealth funds. These investments typically bypass traditional capital markets and banking channels, providing more tailored financing that can support borrowers seeking capital solutions beyond conventional loans, across various stages of growth.

Private Debt encompass a wide range of instruments. They can come in the form of minibonds, issued by SMEs, as well as more structured bonds placed by holding companies, or direct loans such as Term Loans and Revolving Credit Facilities aimed at financing growth projects, acquisitions, at refinancing existing obligations, etc.

Following the Great Financial Crisis (GFC), companies and equity sponsors benefited from a market environment characterized by low interest rates, which fueled substantial capital deployment by the Private Equity industry. The cheaper cost of borrowing facilitated Leveraged-Buyouts (LBOs) and the other strategies commonly used by Private Equity firms. In parallel, high consumer demand further supported the growth of portfolio companies, allowing them to achieve elevated valuation multiples and, therefore, high premiums. The Private Debt market played a crucial role in supporting the expansion of Private Equity investments by providing the necessary financing for acquisitions, other capital-intensive activities and refinancing.

Private Debt’s investor appeal

Private Debt funds have grown globally, including Italy, due to the advantages they offer in terms of risk/return potential. As an inherently illiquid asset class, Private Debt first and foremost allows for a yield premium over more liquid, publicly traded debt instruments. Such premium is one of the primary attractions for institutional investors seeking enhanced returns in a low-yield environment. In addition, unlike market-traded instruments, Private Debt offers several advantages in terms of flexibility, customization and speed of execution.

A notable feature of Private Debt instruments is the use of floating-rate coupons, which offers protection against inflation and helps maintain stability with respect to interest rate fluctuations.

From a risk perspective, Private Debt tends to exhibit lower volatility compared to other more liquid asset classes, and shows limited correlation with other asset classes, which makes it valuable for portfolio diversification.

Private Debt’s ability to generate predictable cash flows makes it well-suited to the needs of investors seeking stable performance over the long term. Indeed, compared to other private market strategies, private debt offers greater visibility into cash flows and stronger capital preservation.

These features fit particularly well the needs of pension funds and insurance companies, which need to guarantee periodic payments to retirees or policyholders and therefore require steady income to meet recurring liabilities.

Fundraising: evolution and geographical presence

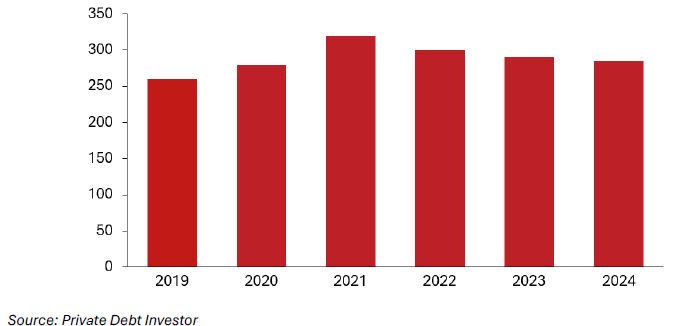

Fundraising volumes for global Private Debt declined slightly in 2024 after consistent growth had led to an all-time high of $332.8 billion in 2021. Volumes fell to $265.1 billion in 2024 from $272.7 billion in 2023, showing a narrowing gap which suggests that decline in capital commitments may be stabilizing.

Private Debt Fundraising ($Bn)

Although fundraising has declined, it has remained reasonably strong by historical standards, and a new fundraising record may be set over the next few years, particularly with funds currently on the market targeting well over half a trillion dollars.

The most notable trend has been the huge increase in the popularity of senior debt funds, which accounted for a whopping 60% of all capital raised, well above any previous year. This may be due to higher interest rates increasing the returns of relatively safe senior debt products. On the matter of size, there was an increasing prevalence of billion-dollar funds in 2024. The average fund size in 2024 approached the $1 billion mark, reaching $984 million, up from $826 million in 2023, almost double the size of five years ago. The trend toward larger funds looks set to continue, with many funds in the market now seeking at least $10 billion.

The recovery in fundraising has been highly uneven, with North America being a clear winner, with vehicles targeting the region accounting for more than half of all funds raised. In contrast, Europe continued to struggle due to a variety of economic and geopolitical headwinds dampening investment demand, and only $41.7 billion was raised during the year. As usual, America continues to lead the way with funds in the market, with more than $256 billion in target capital raised. For Europe, the future may be a bit brighter than 2024, with funds looking to raise $164 billion in 2025.

Strategy diversification: New frontiers to handle current uncertainty

In 2024, 83% of capital raised went to corporate direct lending, the highest proportion on record, but this dominance will likely decline in the coming years as conditions for special situations, credit opportunities and asset-based lending improve.

Following the sudden change in the global financial landscape, other more sophisticated strategies are taking hold. Since the first quarter of 2022, inflation has shown a sudden rise, fueled by the war in Ukraine and the aftermath of Covid-19. In response to rising inflation, the U.S. Federal Reserve began raising interest rates from 0.00-0.25 percent to 5.25-5.50 percent in less than two years. In parallel, the European Central Bank started its most rapid upward cycle in September 2022, raising rates from 0.00-0.50% to 4.00-4.50% in just 10 months. As a result, many companies that had been comfortably able to meet the costs of services and commodities began to encounter liquidity issues pushing them to seek alternative financing solutions. In response, investment strategies such as Credit Opportunities or Special Situations have gained prominence in the market by filling this cash gap and stepping in where traditional financing may be unavailable or insufficient.

The emergence of Credit Secondaries

An increasingly important dynamic shaping the Private Debt landscape concerns the development of its secondary market. With the rising cost of debt and fluctuations in the public markets, both General Partners (GPs) and Limited Partners (LPs) are facing heightened liquidity pressures which have prompted a growing need for portfolio rebalancing across managers, geography, and markets. To cope with this, GPs and LPs have gradually transformed the Private Debt Secondaries market from an avenue where unwanted or low-quality assets can be eliminated to a means of rebalancing the portfolio by selling stakes to secondary buyers. Notably, five years ago, deal sizes did not exceed $100mn aggregately, while single tickets now vary in the range from $100mn to $1bn. As typical, the secondaries market follows the primary market in terms of growth, as the demand for liquidity stems from the primary market itself.

In this context, the Private Debt Secondaries market is at a similar inflection point to that of Private Equity Secondaries in the post-GFC period. In that period, the percentage of the Private Equity Secondary market related to the primary Private Equity volume jumped from 1.8% to 6.5%, reaching a size of $489bn.

This new market is attracting investors because of the many advantages it offers, including:

Immediate exposure and J-curve mitigation: secondary buyers gain immediate exposure to an existing portfolio. This portfolio typically generates cash flow (interest and principal) sooner than primary investments, providing quicker returns and reducing the waiting period for investors.

Diversified portfolio: a secondary fund offers an immediate, diversified portfolio with hundreds of underlying companies. These companies span various vintage years, industries, geographies, security types and even different GPs. This diversification helps mitigate risks and enhances the potential for stable returns.

Limited duration: assets are acquired well into their lifecycle and have significantly shorter expected lives than other credit alternatives.

At the moment, the Private Debt Secondaries market is offering a large pipeline of opportunities with an average yield in the double digits, mainly driven by discounting the benchmark NAV and coupon payments of portfolios acquired already in the harvesting phase.

According to the latest survey from PDI, 21% of investors plan to commit capital to Private Debt Secondaries funds within the next 12 months, marking the highest percentage ever, up from 7% in 2022. At the same time, 31% of LPs are already active in the Private Debt Secondaries fund market, reflecting a positive shift in the understanding of this asset class.

The transaction volume of Private Debt Secondaries has steadily reached new highs each year after 2020, rising to $10.9 billion in 2024, with increasing supply complemented by increased demand from buyers. AUM is expected to reach between $30 billion and $85 billion in 2028F, assuming an adoption rate of 1% to 3% respectively.

Generali Asset Management’s strategic entry

Generali Asset Management (GenAM) is entering the space with its new Private Debt Secondaries fund, launched in partnership with Partners Group. For this purpose, GenAM will leverage the team's market experience and network built up over the years.

Specifically, over the past decade, through its Fund of Funds activity, the Indirect Private Debt team has built a privileged communication channel with more than 250 GPs and more than 120 LPs. The partnership with Partners Group, a leading global player in Private Debt, further strengthens this positioning both from a sourcing perspective (+1400 LPs) and from a due diligence and execution standpoint.

Focus on Italy

Italy has made great strides in the Private Debt segment in recent years, thanks to the overall growth of the market, the size expansion of individual funds, and the general interest of institutional investors. Funding from active players in the sector reached 1,360 million euros in 2024, marking a 13% increase from 1,200 million in 2023. Pension funds and sovereign wealth funds were the main source of funding, contributing 39%, followed by the public sector and institutional funds of funds (28%), and insurance companies (12%). Among pension funds and sovereign wealth funds alone, 54% of capital came from abroad (AIFI data).

Experts insights

Head of Private Assets at Generali Asset Management

“In the future we expect a greater spread of the private debt instrument in the portfolios of investors who already use it and also an arrival of new types of investors, such as HNWI, Mass Affluent and, also Retail investors. With the broadening of the investor base and the percentage allocated to this asset class, it is also reasonable to assume continued growth in the secondary market, a phenomenon we are watching with particular attention. There will be interesting opportunities in the secondary private debt market for investors who are already familiar with the sector.”

Head of Indirect Private Debt at Generali Asset Management

“The growth of the secondary market is due to the increasing propensity of Limited Partners (LPs, or investors) and General Partners (GPs, or managers) to seek immediate liquidity solutions in an illiquid asset class. LP or GP-led transactions involve two different types of sellers, but offer similar advantages. Of these, the most recognizable are the immediate deployment of capital and greater diversification, as funds are purchased that already contain numerous investments and are in the so-called harvesting phase. This results in a rapid distribution of dividends by the fund, with limited duration relative to the primary market. Due to the sellers' need for liquidity, it is possible to obtain significant discounts on these transactions, achieving higher returns than other asset classes with a similar risk-return profile. We believe that the secondary market will transform from a temporary trend, resulting from seller-specific stress situations to a consolidated flow over time, as has already happened in private equity.”

Download the full publication:

* Generali Asset Management forecast based on Preqin, Private Debt Investor, AIFI, BlackRock data